Dear Homebuyer,

Buying a home can be a challenging journey, even for experienced home buyers. In addition to finding a home with the features you want and the complicated contract process, you face other challenges as well.

We have helped hundreds of buyers successfully navigate the process, and created our PATH system to make sure you have the information you need to make the best decisions, find the right home, and avoid regrets. Let us guide you on the PATH to the right home!

Congratulations on deciding to buy a home! This guide will take you through the steps required, and we will provide insights as well. You don’t need to follow it exactly, but, we do recommend you consider each step, especially if you are a first time buyer.

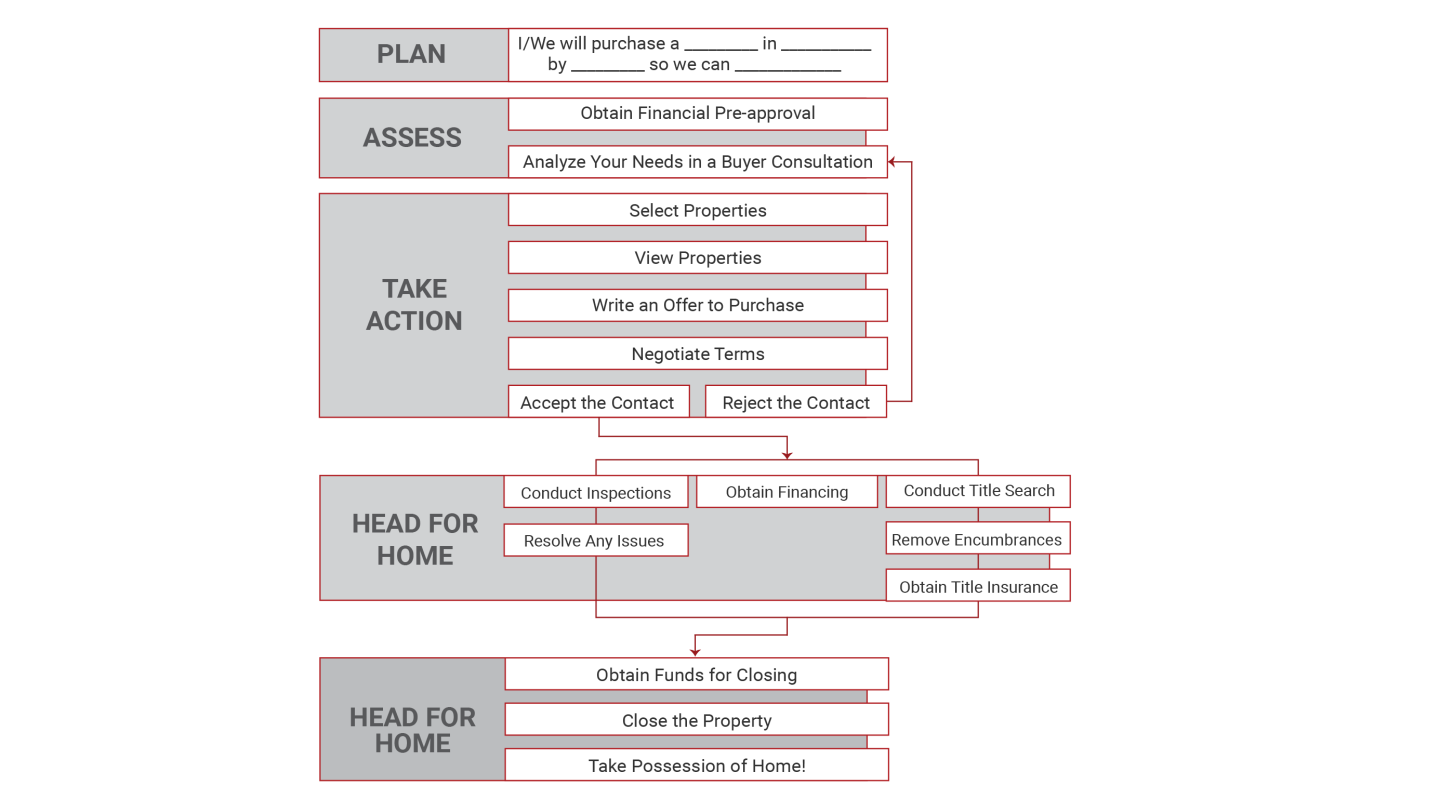

- PLAN: The first and most important step in buying a new home is to develop a plan. For most buyers, making a plan creates clarity, and helps to highlight things, like timing, which need to be factored into the process.

- ASSESS: We will guide you through an assessment of mortgage qualifications and programs, your overall financial position, your work/home location parameters, housing preferences, the housing market, your willingness to do work/renovations, and more. Knowing what you want, and what is possible, saves you time, energy, and frustration.

- TAKE ACTION: After you complete a full loan application, we will search for and visit homes, assess the market and similar properties when writing offers, negotiate the contract, and more. A robust search system based upon a thorough assessment and your stated plan is the best PATH to success.

- HEAD FOR HOME: Once you find a home, we will help you connect with service providers and vendors, mortgage, title, inspections and more. We will help you coordinate every step of the process, from contract, to inspections, finalizing the loan, preparing to move, and going to closing on your new home. Our PATH system will make the homebuying process as stress free as reasonably possible.

PLAN

IT’S ALL ABOUT YOU AND YOUR PLAN

Having a Plan keeps you on track and moving forward with the highest chance of success.

“I/We will purchase a _______________ in ___________ by______________ so we can ___________________”

This sounds simple, and it can be. Writing your plan out can not only help clarify what must be done, it also makes the process seem “real”, and is the bridge between thinking about buying a house, and actually doing it!

We love helping buyers find their dream home. That’s why we work with each client individually, taking the time to understand their unique lifestyles, needs and wishes. This is about more than a certain number of bedrooms or a particular ZIP code. It’s about your life, and it’s important to us.

We will ask you about where you live now, your likes and dislikes, prior homebuying experiences and what you learned, what you want in a home, how you will be financing and more!

Here are a few of the many things we assess, so that you have a clear understanding of what is needed. We use four Ms and two Ws to remember to consider these important topics.

- MONEY: Start the Preapproval Process • Credit Score • Income • Debt • Available Funds • Gifts • Economy • Interest Rates • Housing Inventory • and more.

- MOTIVATION: Why buy? • Dreams vs. Goals • Commitment • Level • Ownership • Future Timeline • Agreement Between Buyers.

- MUST HAVE: Physical Characteristics of Property • Age • Architecture • Rehab to Like New • Lot Size • Distance to Amenities and Work • Walkability • Sidewalks • Friends and Neighbors • Animals • Homes Based Business and more. Preliminary review of available properties to guide choices and set expectations.

- MAY HAVE: Deciding between Must Have and May Have can be a challenge, because most people find themselves limited by their budget, so to keep the must haves, like commuting time, you may have to give up the fireplace, or the granite counters. It can be hard to choose!

- WHERE: Where are you looking and why? • What is your maximum acceptable commute time? • Distance to family, airports, friends, other things? Preliminary search by area Commute time to determine potential properties.

- WHEN: What will impact the timing when you buy a home • Transfer • Raise Larger Family • and more. Are you in a lease? • When does it expire? • Is there an early exit cost? Assess current Days on Market, etc. • Once you have found a home and had a contract accepted, it generally takes 4-6 weeks until settlement happens and the house becomes yours.

WHY PRE-QUALIFY

One of the most frustrating and disappointing things that can happen as a buyer, is to find the perfect home and miss the opportunity to buy it. The prequalification process lets you know what you can afford, which is crucial before you look at your first house. If you look at a house that you love, and then find out you cannot afford it, it will be a bitter disappointment, and we definitely don’t want our clients to experience that!

To learn more about Why Is it Important to Prequalify For a Mortgage? Click Here!

HOUSE SEARCHING

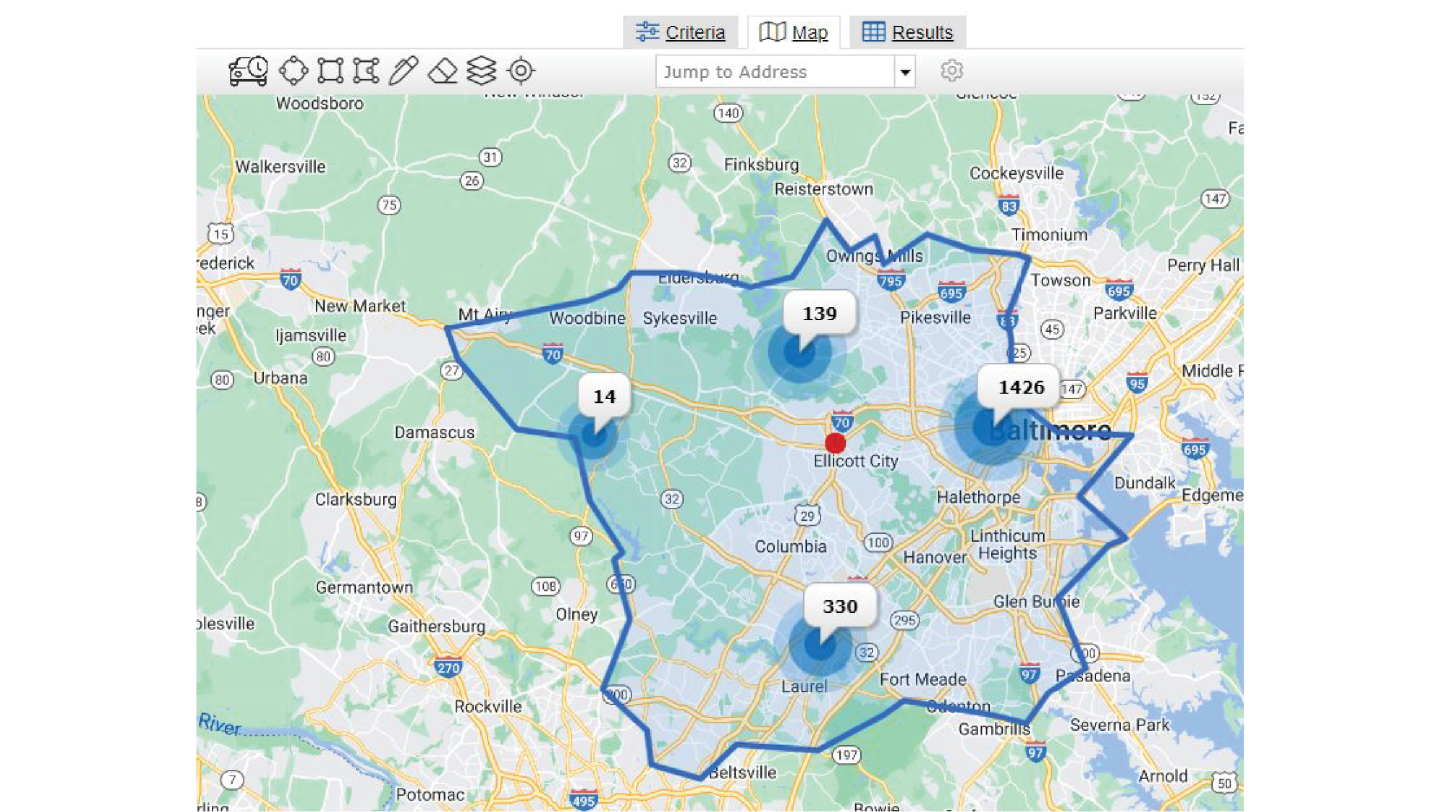

We will set up a search in the Multiple Listing Service (MLS) where all homes that are listed for sale are visible - the MLS search we will do is the most accurate, and includes the ability to search by multiple commuting time calculations, and over 100 other variables.

To learn more about What Type Of House Best Suits Your Needs? Click Here!

SHOWINGS

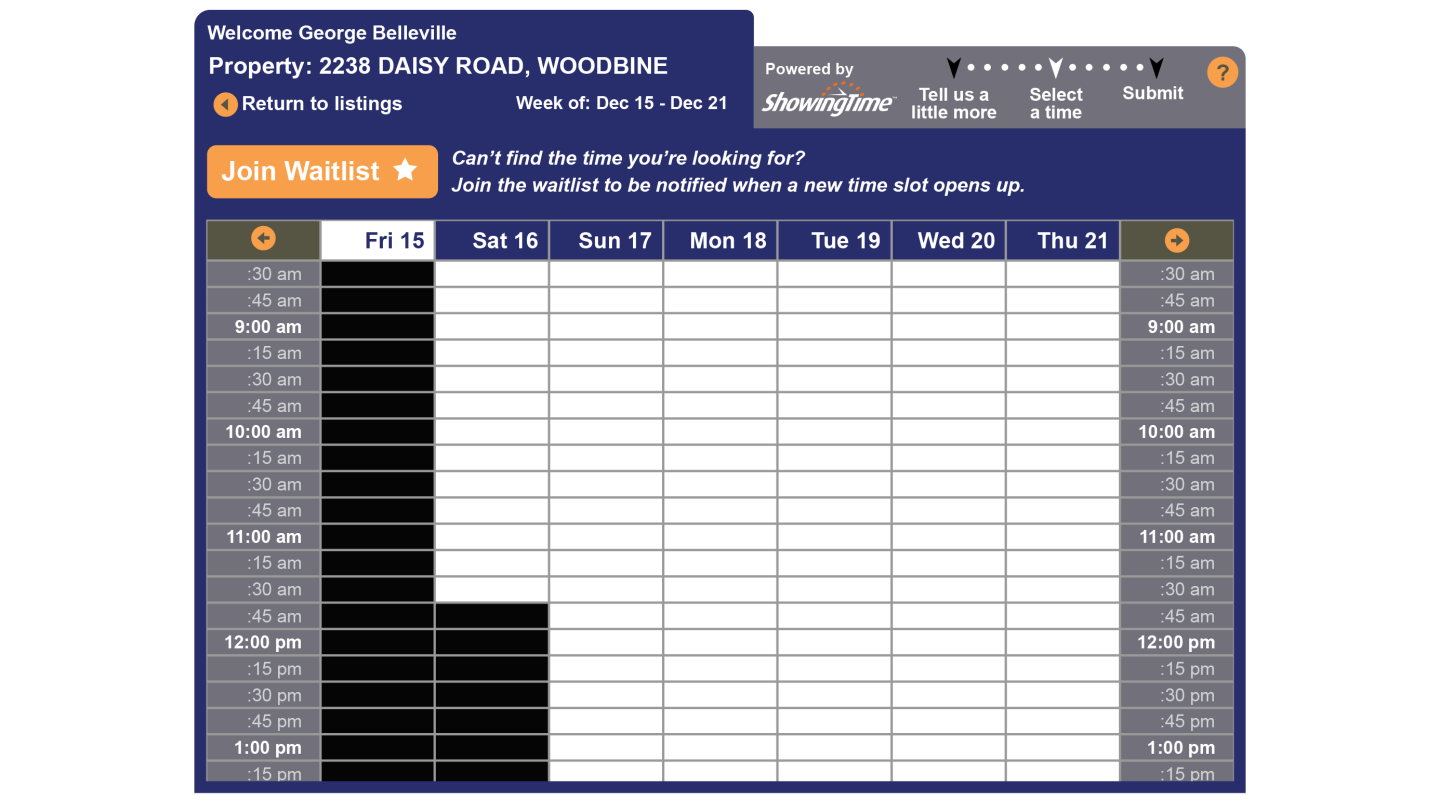

Showings need to be scheduled, and we make the appointment according to the instructions in the MLS. Sometimes 24 hour notice is required, so we make these arrangements at least a day in advance, if possible. Showing houses on Thursday and Fridays allows you to beat the weekend rush, and gives you some time to think about any property that you want to pursue. We also recommend looking at 3 to 5 properties per showing tour.

To learn more about What Do Buyers and Agents Look at in a House? Click Here!

MAKING AN OFFER

Once you have found the property you want, we will write a contract of sale. While much of the agreement is standard, there are a few areas that we can negotiate.

THE PRICE

What you offer on a property depends on a number of factors including its condition, length of time on the market, buyer activity, and the urgency of the seller. While some buyers want to make a low offer just to see if the seller accepts, this often isn’t a smart choice, because the seller may be insulted and decide not to negotiate at all. We will thorughly evaluate the market near the property for you, so you can make the best decision, feeling confident that you are doing your best.

To learn more about What Is a Fair Price For a House? Click Here!

INSPECTIONS / SELLER CREDITS

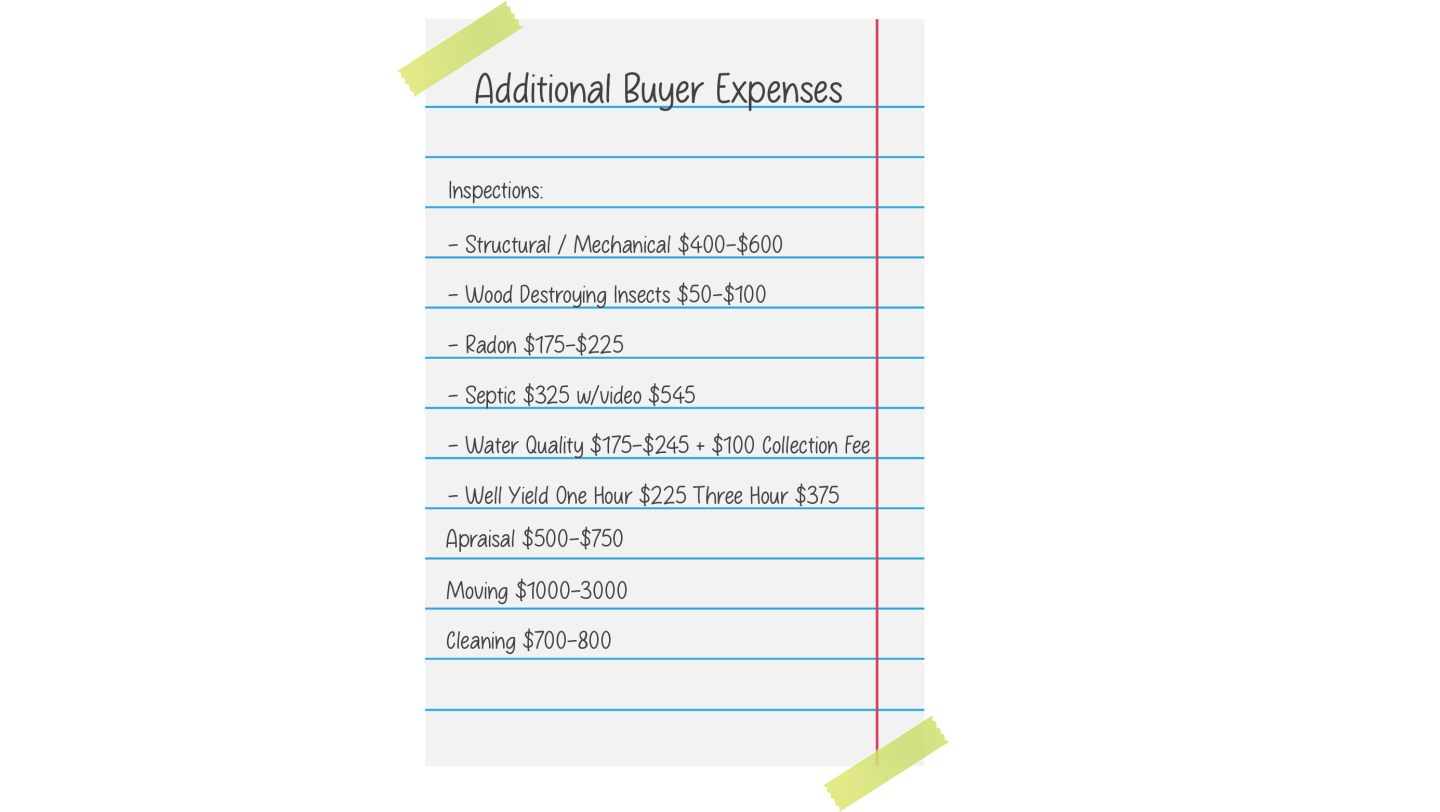

When making an offer to buy a home, remember to account for inspections and seller credits. An inspection can reveal issues that affect the property’s value and you may request the seller to fix them or provide credits to cover the cost. Include contingencies in your offer to back out if significant issues arise during the inspection. Decide whether to request seller credits for closing costs or other expenses, but be aware that this can affect the seller’s willingness to accept your offer.

To learn more about this, check out this video: What Inspections Should I Have?

THE MOVE-IN DATE / RENT BACKS

If you can be flexible on the possession date, the seller will be more apt to choose your offer over others.

SELLER RESPONSE

Typically, you will not be present at the offer presentation - we will send it to the listing agent. The seller will then do one of the following:

- Accept the offer

- Reject the offer

- Counter the offer with changes

By far the most common is the counteroffer. In these cases, our experience and negotiating skills become powerful in representing your best interests. When a counteroffer is presented, we will work together to review each specific area of it, discuss it with you, making sure that we move forward with your goals in mind and ensuring that we negotiate the best possible price and terms on your behalf.

Check our these videos to learn more about:

What Happens When Your Offer Is Accepted?

What To Do When Your Offer is Not Accepted?

OFFER ACCEPTED

When you and the seller have signed the contract, it is considered accepted. You will need to provide an initial deposit, and arrange for the agreed upon inspections and financing if necessary. If everything goes smoothly and all conditions are met, the sale will close, and you’ll transfer funds to the seller, becoming the new owner of the property.

INSPECTION

An inspection is a crucial part of the home buying process. It is a thorough examination of a property’s condition by a licensed professional, usually a home inspector. As a buyer, you can expect the inspector to assess the house’s major systems, including the electrical, plumbing, heating, and cooling systems, as well as the roof, foundation, walls, and other structural elements.

The inspector will look for any defects, damage, or safety hazards that could affect the home’s value, livability, or safety. The inspector will then provide a detailed report outlining their findings, which can help you make an informed decision about whether to proceed with the purchase, negotiate repairs or credits, or walk away from the purchase. It’s important to attend the inspection and ask questions to ensure you have a clear understanding of the property’s condition.

During unusually strong seller markets, where there is a great deal of competition for homes, some buyers will choose to forgo some or all of the possible home inspection options. While this may make your offer more competitive, it removes your ability to obtain an opinion about the house from a trained professional. While our agents are very well trained and experienced, we are not home, well, or septic inspectors and we consider this to be extremely risky.

APPRAISAL

Your lender will order an appraisal, which is an evaluation of a property’s value by a licensed appraiser. As a buyer, you can expect the appraiser to assess the property’s condition and compare it to similar homes in the area to estimate its fair market value. The appraisal is typically required by a lender before approving a mortgage. If the appraisal comes in lower than the purchase price, you may need to renegotiate the terms of the sale or come up with additional funds to cover the difference.

To learn more about this, check out this video: What Additional Buyer Expenses Should I Know About?

PREPARE FOR CLOSING

After the inspection and appraisal are completed, the final stages of your loan are:

- Underwriting

- Loan package is submitted to underwriter for approval

- Loan approval

- Parties are notified of approval

- Loan documents are completed and sent to title

- Title company

- Title exam, insurance and title survey conducted

- Borrowers come in for final signatures

- To learn more about this, check out this video: How to Select a Title Company?

- Funding

- Lender reviews the loan package

- Funds are transferred by wire

CLOSING DAY

Closing day marks the end of your home-buying process and the beginning of your new life! To make sure your closing goes smoothly, you should bring the following:

- A certified check or wire for closing costs and down payment. Make the check payable to yourself; you will then endorse it to the title company at closing

- An insurance binder and paid receipt, usually obtained by lender in advance

- Photo IDs

- Social Security numbers

OWN IT

Transfer of title moves ownership of the property from the seller to you. The two events that make this happen are:

- Delivery of the Buyers Funds: This is the check or wire funds provided by your lender in the amount of the loan, directly to the tile company

- Delivery of the Deed: A deed is the document that transfers ownership of real estate. The deed names the seller and buyer, gives a legal description of the property, and contains the notarized signatures of the seller and witnesses.

At the end of closing, the deed will be taken and recorded at the county clerk’s office. It will be sent to you after processing.

How long does it take to buy a home?

The time it takes you to find the property you want varies with the number of homes for sale. It can be from days to months. Once you have found a home and had a contract accepted, it generally takes 4-6 weeks until settlement happens and the house becomes yours.

Why am I seeing listings on the App you didn’t send me?

It is very likely that you will want to use one of the many apps to look for homes that are available, in addition to the listings we send you . However, if you are seeing houses that I am not sending you, that means you have changed your search criteria. If you have decided you are willing to drive farther, or give up a garage space, etc, it is important to tell us, so we can adjust our search in the MLS. We need to stay on the same page!

Can you help me find new construction homes?

Yes, we can work with most builders and get you the information you need to make a decision. On your first visit with the builder, we will accompany you. By using our services with a new construction home purchase, you will receive the services we offer, as well as those provided by the builder, at no additional cost. The compensation to agents by builders can be complicated, and different than what is offered by resale properties, so we will discuss the details depending upon the new home community.

How does For Sale By Owner (FSBO) work?

Homeowners trying to sell their home without agent representation are usually doing so in the hopes of saving the commission. If you see a FSBO, let us contact the owner for you and make an appointment. Most times the homeowner will work with an agent even though their home is not listed, since the agent is introducing a potential buyer to their property, and has the knowledge and systems to handle the complex process.

Once my offer is accepted, what should I do?

Celebrate, and start thinking about moving into your new home! After all the contingencies are met, you will want to schedule your move, pack items and notify businesses of your address change. We will provide you with a moving checklist, a good faith estimate and settlement cost statement, which will indicate the amount you will need to bring to closing.

To download a PDF version of this Home Buying P.A.T.H., Click Here!

Thank you for the opportunity to present our qualifications, systems, and plan to help you buy your new house.